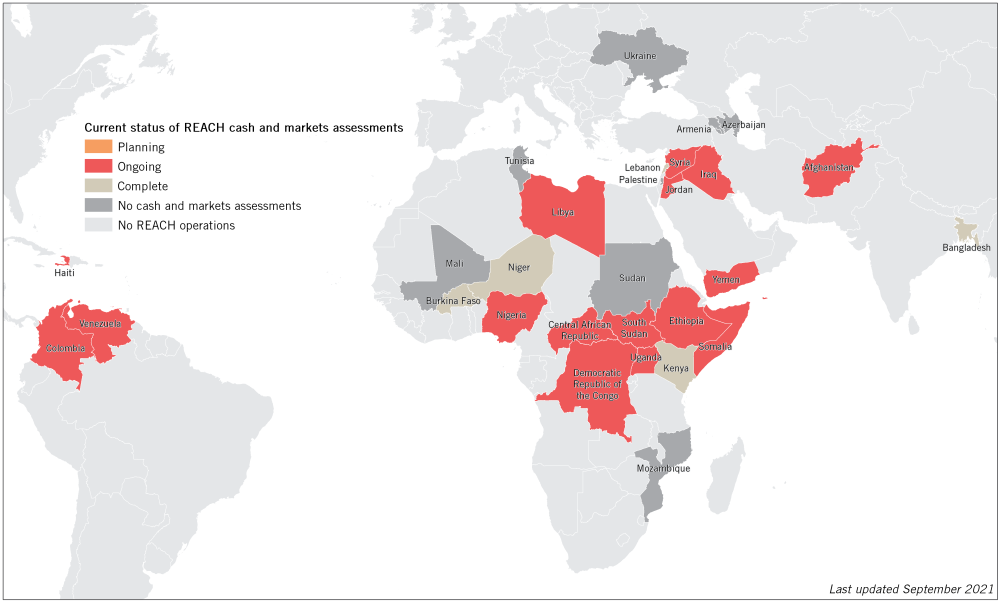

Statement – In collaboration with national cash working groups, UN agencies, implementing partners, and donors, REACH works globally and nationally to address core information gaps in cash and voucher assistance (CVA) and provide evidence to support more effective CVA interventions.

As of April 2020, REACH’s work in CVA spans 20 countries and four main themes:

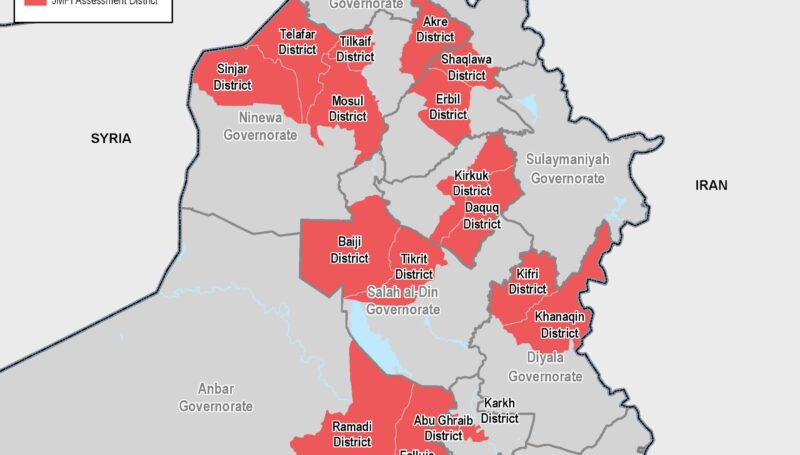

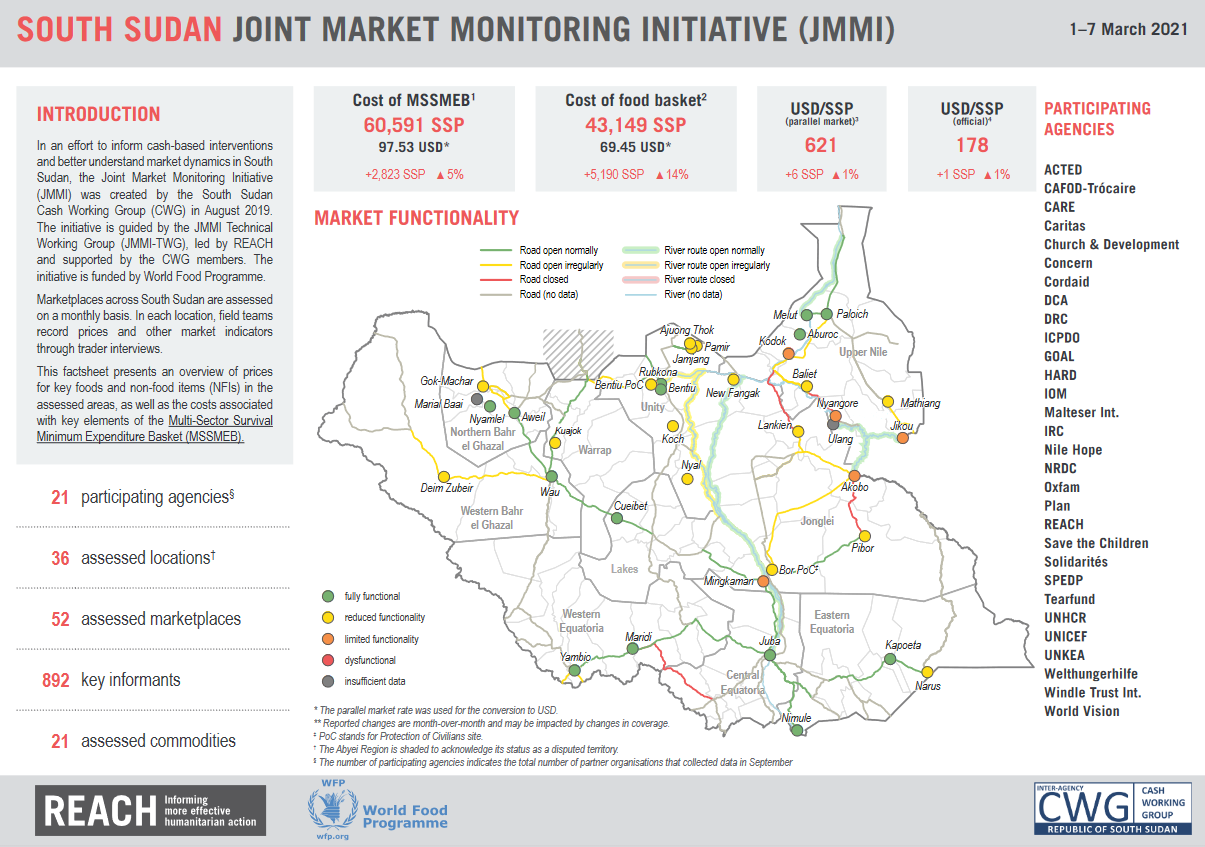

- Harmonised, inter-agency Joint Market Monitoring Initiatives (JMMIs) that bring together many cash actors to regularly collect data on market prices, functionality, and accessibility, which enables the calculation and adjustment of local Minimum Expenditure Baskets as well as of the standard transfer values used in multi-purpose cash.

- Coordinated Joint Rapid Assessments of Markets (JRAMs) that provide a quick snapshot of how and whether markets are able to respond effectively to a well-defined shock.

- More in-depth cash feasibility studies and market assessments that aim to answer larger questions about the structure and functionality of local markets and to support evidence-based advocacy for the most effective aid modality available.

- Thematic assessments tailored to fill specific information gaps: for example, financial service provider assessments, labour market assessments, post-distribution monitoring systems for CVA programmes, and others.

Market monitoring and analysis has the potential to better inform CVA assistance in an effort to help various population groups meet their basic needs. Such assessments are also often designed to monitor the financial burdens placed on households by humanitarian crises, and whether these vulnerable households can reasonably access the goods and services within their local markets. Ensuring that physical, financial, and social access is maintained is paramount for them to meet their needs.

For more information

Data and analysis from all of our cash and markets assessments conducted around the world can be found here on the IMPACT Resource Centre.

23/02/24 – Moldova – Round 2 results reflect evolving rental landscape for Ukrainian refugees

Round 2: Observing changes in the rental market over time

Round 1 of the assessment found that rental accommodation was unaffordable for many refugees, that many refugees had informal rental agreements to maintain flexibility and reduce the cost of renting, and that some refugees had faced discrimination when looking for rental accommodation, among other findings. Round 2 of the assessment sought to observe changes in rental market dynamics over time and fill the remaining gaps identified in Round 1, including the specific difficulties faced by refugees with mobility disabilities in the rental market and the impact of the recently implemented Temporary Protection status on refugees’ access to rental housing. This assessment was made possible thanks to the partnership with the European Union.

Round 1 of the assessment found that rental accommodation was unaffordable for many refugees, that many refugees had informal rental agreements to maintain flexibility and reduce the cost of renting, and that some refugees had faced discrimination when looking for rental accommodation, among other findings. Round 2 of the assessment sought to observe changes in rental market dynamics over time and fill the remaining gaps identified in Round 1, including the specific difficulties faced by refugees with mobility disabilities in the rental market and the impact of the recently implemented Temporary Protection status on refugees’ access to rental housing. This assessment was made possible thanks to the partnership with the European Union.

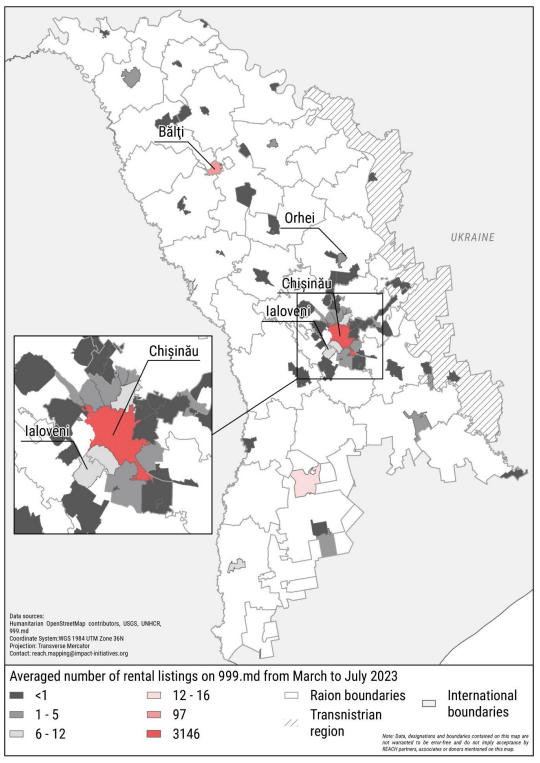

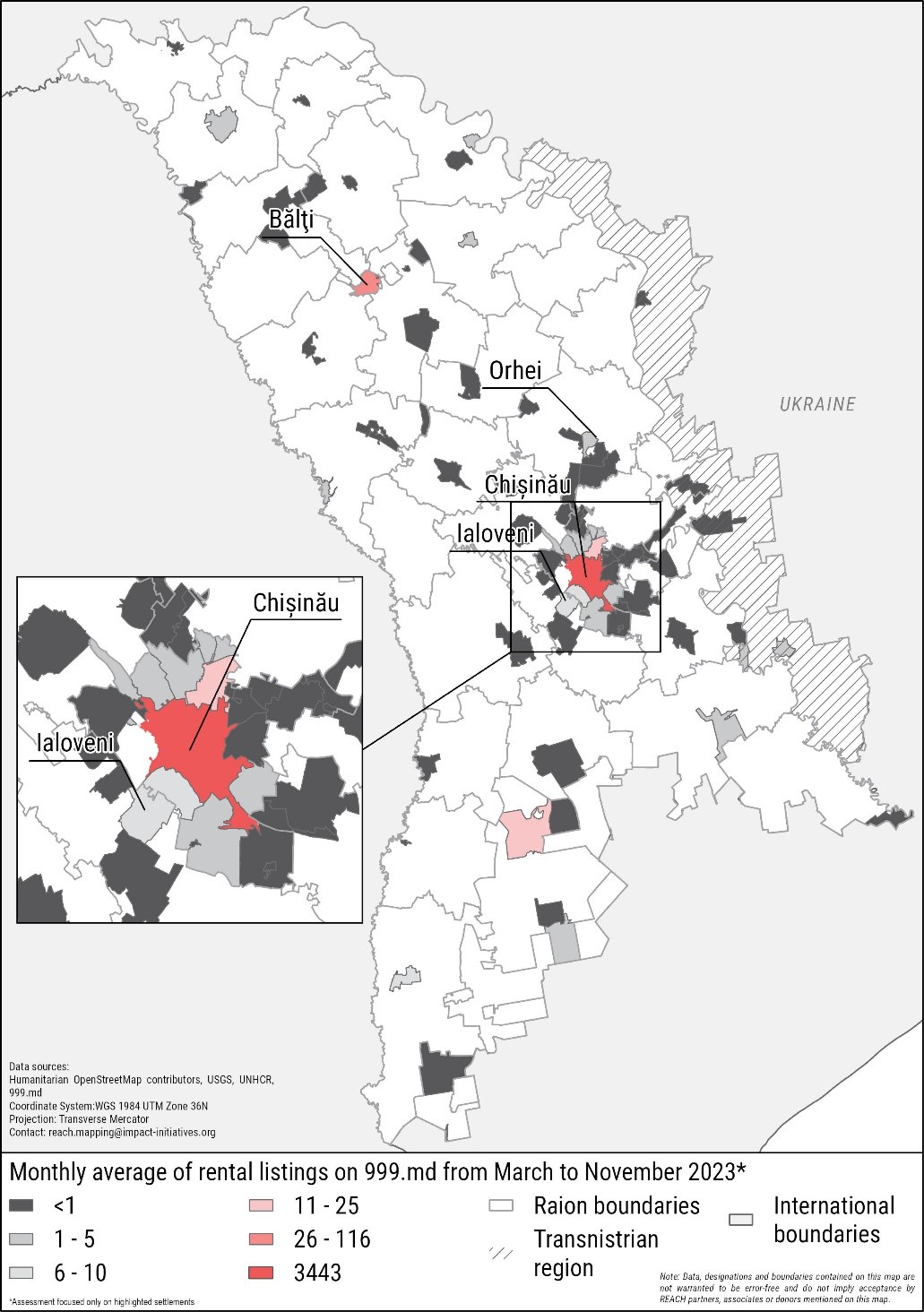

As was conducted in Round 1, REACH interviewed refugee tenant households, rental service providers including landlords and real estate agents, and other key informants with specialist knowledge of the rental market and the experience of refugees. Focus group discussions with refugees and the host community were also conducted, along with the monitoring of rental advertisements on a major rental advertisement website known as 999.md, in order to assess the availability and affordability of rental accommodation in Moldova. Additionally, refugees with mobility disabilities were interviewed in Round 2 to better understand their experiences in the rental market. The assessment focused on four localities: the urban centres of Chișinău and Bălți, and the semi-urban localities of Ialoveni and Orhei.

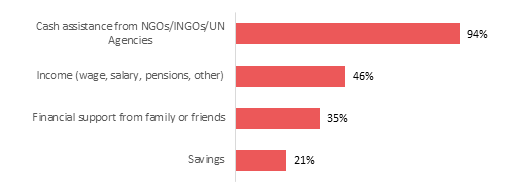

More refugees are relying on cash assistance to afford rent

94% of surveyed refugee households in Round 2 relied on cash assistance as one of their financial resources to afford their latest rent payment compared to only 67% of the households in Round 1. Only 46% relied on income. Additionally, over half of the households considered an end to cash assistance as the most likely reason that could lead to an eviction. This suggests that strategies to decrease refugees’ reliance on financial assistance are needed to support their ability to afford rental accommodation in the long term.

This reliance on cash assistance could also be due to the steady increase in rental prices in Moldova, as the average price of rental accommodation advertised on 999.md from March to November 2023 increased by €132. Though the average advertised rental price during this period was €432, surveyed refugee households during Round 2 paid an average monthly rent of €234, suggesting a continued preference for affordable housing possibly due to an inability to afford accommodation at the average market rates.

Among the rental service providers typically requesting a deposit from tenants in Round 2, most were requesting a deposit of two months’ rent, while several in Bălți were requesting six months’ rent. 40% of surveyed households in Round 2 had paid a deposit for their rental accommodation, of which the average paid was €490. The average paid in semi-urban locations was higher than that paid in urban locations.

The average cost of utilities declined by more than half in most locations between Round 1 and Round 2. This could be reflecting a more stable country programme for energy consumption compared to the beginning of 2023. However, the cost of heating in the winter months that followed the period of data collection likely led to an increase in the average cost of utilities.

Discrimination continues to impede refugees’ access to rental accommodation

Discrimination against refugees by landlords was the greatest difficulty faced by surveyed households searching for rental accommodation in Round 2 of the assessment. This was connected to landlords’ concerns that refugee tenants would damage their property, particularly if the household includes pets, children, or people with disabilities. The perception that aid has been given exclusively to refugees instead of also to members of the host community is said to have also created a more negative perception of refugees in Moldova, leading to discrimination.

While searching for housing, 60-70% of landlords, upon hearing that we are Ukrainians, immediately refused.

Focus group discussion participant in Bălți

We even know two or three cases that when the landlord found out that the refugee is receiving help for rent, they increased the prices.

NGO representative in Ialoveni

Relationships between refugees and host communities were described as mostly positive in Round 2, but with reports of discrimination and stigmatisation. 56% of surveyed households consider their accommodation to be in a neighbourhood or community that welcomes their presence, while 11% did not feel welcome in their community and 33% were unsure. Households in the semi-urban settlements of Ialoveni and Orhei reported feeling the most welcome in their communities.

In Bălți, we encountered local discontent with the fact that we were paying financial aid to Ukrainians. Housing was scarce, the demand increased and so did the prices. There was tension between the locals and Ukrainians.

NGO Representative in Bălți

A lack of rental housing suitable for refugees with mobility disabilities

Finding accessible housing is the main difficulty faced by refugees with mobility disabilities. Greater focus needs to be put on the adaptation of rental housing to their needs, including the installation of accessibility infrastructure for people with disabilities. Few legal protections exist to ensure the accessibility of rental housing to people with disabilities in Moldova.

Many refugees with mobility disabilities are struggling to afford rent and any additional expenses related to their disability. Most are reportedly unemployed and relying solely on their pensions or assistance from NGOs.

This month we have no money to pay the rent because we bought pills and injections for me. I am constantly faced with the choice of either getting treatment and eating or paying the rent.

Household in Ialoveni

Looking ahead

The assessment findings highlight the need for continued support to refugees in securing adequate mid-term accommodation through the Moldovan rental market. This need is even higher for vulnerable groups, particularly people with mobility disabilities who face a greater financial burden and scarcity of accommodation adapted to their needs. Therefore, more targeted interventions for this vulnerable group may be appropriate. Additionally, greater consideration is needed on how to address continued discrimination against Ukrainian refugees in the rental market.

Read the full report of Round 2 of the Rental Market Assessment here.

—

21/11/23 – Moldova – Insights into the rental landscape for Ukrainian refugees

In response to the acute need for adequate accommodation by Ukrainian refugees arriving and remaining in Moldova following the escalation of the war in neighbouring Ukraine, REACH – a joint initiative of IMPACT Initiatives, Acted and the United Nations Operational Satellite Applications Programme (UNOSAT) – conducted research to better understand the Moldovan rental market. Findings from the research are being used by implementing partners in supporting refugees to find and maintain adequate mid-term accommodation.

Over a year and a half has passed since the escalation of war in Ukraine in February 2022. As of October 2023, Europe has recorded 5.8 million Ukrainian refugees, with over 830,000 Ukrainian nationals seeking refuge in Moldova since the crisis began. Among them, 113,000 Ukrainians and 7,800 third-country nationals currently call Moldova home. In response to this significant influx, the Moldovan Government and the humanitarian community have made substantial efforts to meet the diverse needs of the refugee population, particularly in providing accommodation.

While Refugee Accommodation Centres (RACs) continue to offer temporary housing and basic assistance to the most vulnerable, the majority of refugees reside within Moldova’s host communities. To support these households, several rental assistance programmes, including Acted’s EU-funded Cash for Rent programme, aim to secure accommodation in the medium term, reflecting a shift in the refugee response towards more extended support.

Assessing the accommodation challenge

It is widely acknowledged that refugees need support in accessing adequate mid-term accommodation. However, limited information is available for them, whether about costs, availability, conditions for renting, or other crucial elements for tenants seeking houses. To bridge these information gaps and support the design of rental assistance programmes for refugees, REACH, in partnership with its PLACE consortium partners – Acted, IMPACT Initiatives, NRC and People in Need, conducted a comprehensive assessment of Moldova’s rental market dynamics and of the rental experiences of refugees from Ukraine. This assessment was made possible thanks to a funding from the European Union.

To achieve its research objective, REACH conducted interviews with refugee tenant households, rental service providers (RSPs), and other key informants with specialist knowledge of the rental market. Additionally, focus group discussions were conducted, and advertisements of rental accommodation on the rental advertisement site, were monitored to assess the availability and affordability of rental accommodations in Moldova. The assessment was focused on four distinct localities: the urban centres of Chișinău and Bălți, along with the semi-urban localities of Ialoveni and Orhei. Data collection occurred during March and April 2023.

Analysis of the data sheds light on the challenges faced by refugees seeking accommodation and highlights the main concerns that can be addressed through the efforts of implementing partners in the response.

Rental accommodation is not affordable for many refugees.

Surveyed refugee households in Chișinău paid an average monthly rent of around €275, notably less than the €418 average listed on 999.md, signalling a preference for affordable housing among refugees. This, coupled with the initial exhaustion of rental properties post-conflict escalation, may have led to occasional tensions between host and refugee communities in urban areas vying for affordable housing. Nevertheless, relationships between these groups were described as mostly positive.

Financial barriers were a recurring issue for refugees, suggesting that renting had not been an affordable accommodation solution for many refugees in Moldova. The strain was particularly pronounced for unemployed refugees, and other vulnerable groups, including women, especially those with children, people with disabilities and older individuals unable to work. Moreover, financial burdens are likely to be heightened in winter as energy costs increase.

While cash assistance offered some relief, it wasn’t enough to guarantee stable housing. A concerning proportion of surveyed refugee households, nearly four out of five, expressed fear of eviction, making the discontinuation of cash assistance a major worry. This highlights the pivotal role of cash assistance in ensuring refugee housing security, as a reduction or end to this support could trigger evictions due to missed payments.

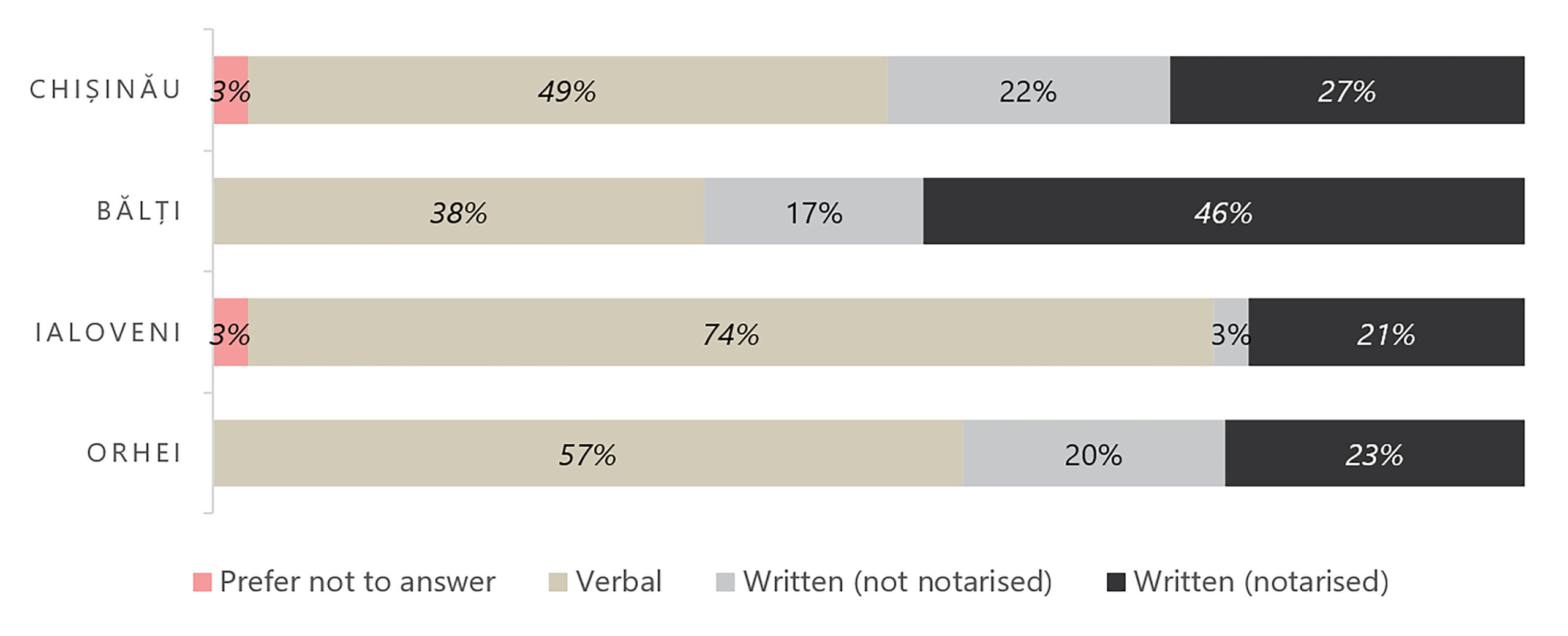

Figure 1: Type of contract with the rental service provider as reported by surveyed households* *Totals may not add up exactly to 100% because of rounding.

Many refugees have informal rental agreements to maintain flexibility and reduce costs

Many refugees opt for informal rental agreements for flexibility and cost savings. These agreements are typically favoured because, as per feedback from focus group discussions (FGDs) with refugee communities, formal rental contracts often pose difficulties due to rental service providers’ unwillingness. This issue previously hindered access to Temporary Protection status, which required a notarized formal rental agreement as proof of residence. However, as of September 2023, this document is no longer necessary (UNHCR). Formal agreements were more common in Chișinău and Bălți, while informal agreements prevailed in Ialoveni and Orhei.

Informal agreements benefit both rental service providers and refugee tenants. Providers can avoid state taxes, eliminate the need for a notary to draft contracts, and save time on official registration. For refugee tenants, these agreements offer flexibility in contract duration, potential cost savings – as some providers charge extra for formal agreements – and the ability to remain anonymous. However, while informal agreements provide flexibility and cost advantages, they can leave refugee tenants susceptible to sudden eviction or disputes, compromising their long-term housing stability and rights in the rental market.

“Many landlords usually tell people that the price without a contract is lower and with a contract it is higher”

– Rental market expert

Discrimination faced by refugees in accessing rental accommodation

Though relationships between refugees and the host community were described as mostly positive, there were some reports of discrimination and stigmatisation against refugees. Discriminatory reluctance from rental service providers to lease to refugees has reportedly been a social obstacle for some refugees to accessing rental accommodation. This has been linked to fears of tenants damaging property, particularly if the household includes children, people with disabilities, or pets; concerns that refugees may leave without paying; and communication issues related to the language barrier. Roma refugees have reportedly faced additional discriminatory reluctance from RSPs to provide rental accommodation.

“Initially, refugees sought rent on their own, but when landlords found out that people were from Ukraine, they refused outright or charged an inflated price”.

– Key Informant from the local authorities in Orhei

The assessment findings highlight the need for continued support to refugees to secure adequate mid-term accommodation in the rental market in Moldova. This is particularly so for more vulnerable groups of refugees such as women with children, persons with disabilities, and older refugees.

REACH will continue to monitor the dynamics of the rental market for refugees in Moldova in the second round of the assessment, which is being conducted from October 2023 to January 2024. To address the additional evidence gaps identified in the first round of the assessment, REACH will incorporate a dedicated focus on the challenges faced and the needs of refugees with mobility-related disabilities. In light of the implementation of the Temporary Protection status for Ukrainian refugees since March 2023, the second round is also expected to produce findings on any changes to rental market dynamics that the measure may have brought about.

For more information on the findings of the assessment and the methodology used, you can access the links to the REACH Resource Centre below:

Rental Market Assessment Round 1 Report

999.md Datasets from March, April, May and June 2023

31/08/22 Contingency planning in northwest Syria: unpredictable aid flows and a vulnerable population

Following an initial veto from Russia, the UN Security Council voted last month to extend a resolution that facilitates cross-border humanitarian aid into northwest Syria for another six months. This decision temporarily mitigated the loss of a vital source of assistance for 4.1 million Syrians in this region, who rely heavily on food and other necessities that are delivered from Turkey through this corridor.

However, the relatively short duration of the extension remains a concern for humanitarian organisations operating in the region – especially as the fate of any future renewal will again rely on Security Council geopolitics. Given this uncertainty, there is an urgent need for contingency planning. Aid actors are looking into the pre-positioning of supplies, although locally procuring food and in-kind items is another modality to be explored, in this uncertain context.

To inform these planning efforts, REACH piloted a supply chain analysis exercise in Sarmada and Dana central markets in Idlib governorate. The exercise targeted 148 individual retailers and assessed availability of 52 non-food commodities that are typically distributed to households in need through Shelter and Non-Food Item (SNFI) or Water, Sanitation, and Hygiene (WASH) kits.

Overall, the study found that local procurement of core SNFI and WASH items is possible in Sarmada and Dana, indicating that it may be possible in other areas of Syria as well. Vendors were generally confident that they would be able to supply these items according to the correct specifications, but the availability of all kit items was rarely reported by a single vendor, meaning that multiple vendors would be required to be contracted.

- Read our full supply chain analysis report for detailed findings from the study including market dynamics, stocking and sourcing, and vendor perceptions on markets and prices

[metaslider id=”4650″]

Further analysis by REACH shows why the need for sustained and predictable humanitarian aid to northwest Syria is vital: the dire economic situation in Idleb province and its surroundings, combined with the prolonged impacts of the 11-year conflict, have exacerbated needs and vulnerabilities among the population.

Findings suggest that the economic situation in Greater Idleb, after having suffered severely from the conflict, is currently made more difficult by the rapid depreciation of the Turkish lira and the market impacts of the Ukraine crisis. Prices of essential items have risen significantly over the past months, and incomes have not kept up. This has left households who are already struggling with food insecurity, lack of healthcare, and low school attendance rates worse off.

To cope with diminishing purchasing power, households are increasingly relying on negative coping strategies, including increasing debt by buying essential items on credit, skipping meals, child marriage among families with girls, and sending children to work, in particular adolescent boys.

- Read our full economic trends and humanitarian impacts report for detailed findings from this analysis, including price changes observed in markets in Greater Idleb, changes in employment and wages, and the household-level impacts of these changes since November 2021.

07/07/22 SYRIA – Analysis of JMMI data, Humanitarian Situation Monitoring, and a June rapid assessment reveal dire economic conditions in Greater Idleb

The UN Security Council resolution that currently facilitates cross-border humanitarian aid into northwest Syria is set to expire on Monday. As the deadline looms and debate within the Security Council continues, concerns are growing that Russia may veto the renewal of this resolution. The result of this decision could be catastrophic for the 4.1 million Syrians in this region who rely heavily on food assistance and other aid that is delivered from Turkey through this corridor.

A new report produced by the REACH Syria team, providing an integrated analysis of multiple data sources from Idleb province and its surroundings, puts the urgency of this decision into context. The economic situation in Greater Idleb, after having suffered severely from the conflict, is currently made more difficult by the rapid depreciation of the Turkish lira and the market impacts of the Ukraine crisis. Prices of essential items have risen significantly over the past months, and incomes have not kept up. This has left households who are already struggling with food insecurity, lack of healthcare, and low school attendance rates worse off.

- The price of monitored food products increased on average by 34%, hygiene items by 46%, and fuels by 43% between November and December 2021.

- In the aftermath of the conflict escalation in Ukraine, food prices in Greater Idleb rose further – e.g. a 60% increase in the cost of cooking oil from February to March 2022

- Agricultural inputs were increasingly reported to be unaffordable, according to interviews conducted in May

To cope with this diminishing purchasing power, households are increasingly relying on negative coping strategies, including increasing debt by buying essential items on credit, skipping meals, child marriage among families with girls, and sending children to work, in particular adolescent boys.

This report provides an analysis of these trends. It focuses on the price changes observed in markets in Greater Idleb, the changes in employment and wages, and the household-level impacts of these changes since November 2021.

[metaslider id=”4563″]

03/06/22 – UKRAINE – Rapid market analysis in Ukraine: A case study on how research methodologies evolve in the early stages of a crisis

In the days and weeks after the escalation of the conflict in Ukraine in February 2022, humanitarian actors found themselves quickly mobilizing to respond to growing needs inside the country, despite a lack of complete data to support how these operations would be planned or implemented. This is a common scenario in many sudden onset crises, where in the immediate aftermath of an emergency-inducing event, the urgency to react is high while available information is low.

One of the key information gaps early in the Ukraine crisis had to do with the sudden disruption of major supply routes for key commodities, especially as domestic production was also being affected by active conflict and displacement. These factors contributed to food shortages and limited access to basic items needed by households.

To support operational actors seeking to address these challenges, in March 2022 – just three weeks after the escalation of the conflict – REACH produced its first rapid analysis of markets and supply chains inside Ukraine. This analysis combined traditional data collection methods, like compiling available secondary sources and conducting key informant interviews with consumers in Lviv, with a more innovative approach: the collection of actual price data and product availability information through online shopping portals.

[metaslider id=”4529″]

Using this approach, REACH conducted a rapid monitoring exercise across nearly every shops belonging to the large Ukrainian supermarket chain ATB. This chain offered a searchable and regularly updated online database that showed both availability and price of products, the accuracy of which was confirmed through spot checks across several regions. Due to the lack of direct access to stores and markets in many parts of the country, this remote approach was crucial to help humanitarian actors build a case for the feasibility of cash and voucher assistance (CVA) across Ukraine.

The resulting analysis had to take into consideration some inherent limitations, namely that not all stores were able to update their data regularly in the current environment, and certain stores could not be included if they were non-functional due to the conflict. However, collecting data in this way still helped to build an indicative picture of the availability of 19 core food and hygiene items across the whole country, which in turn could be analysed to produce a Food Item Availability Score and NFI Availability Score for each assessed town.

After two rounds of rapid market analysis in March and April 2022, REACH and its partners in the Ukraine Cash Working Group (CWG) collaborated to launch a full-fledged Joint Market Monitoring Initiative (JMMI). The JMMI, based on a methodology used by REACH in 17 countries to date, brings together many CWG partners to jointly collect data each month on market prices, availability, accessibility, and functionality from retailers and customers throughout the country. Starting in May 2022, REACH’s rapid market analysis methodology will be directly integrated into the JMMI, expanding the initiative’s coverage greatly and providing cross-comparable price and availability data across most of the country.

Read more about the Ukraine JMMI and its use for understanding market trends on our Ukraine Crisis Thread.

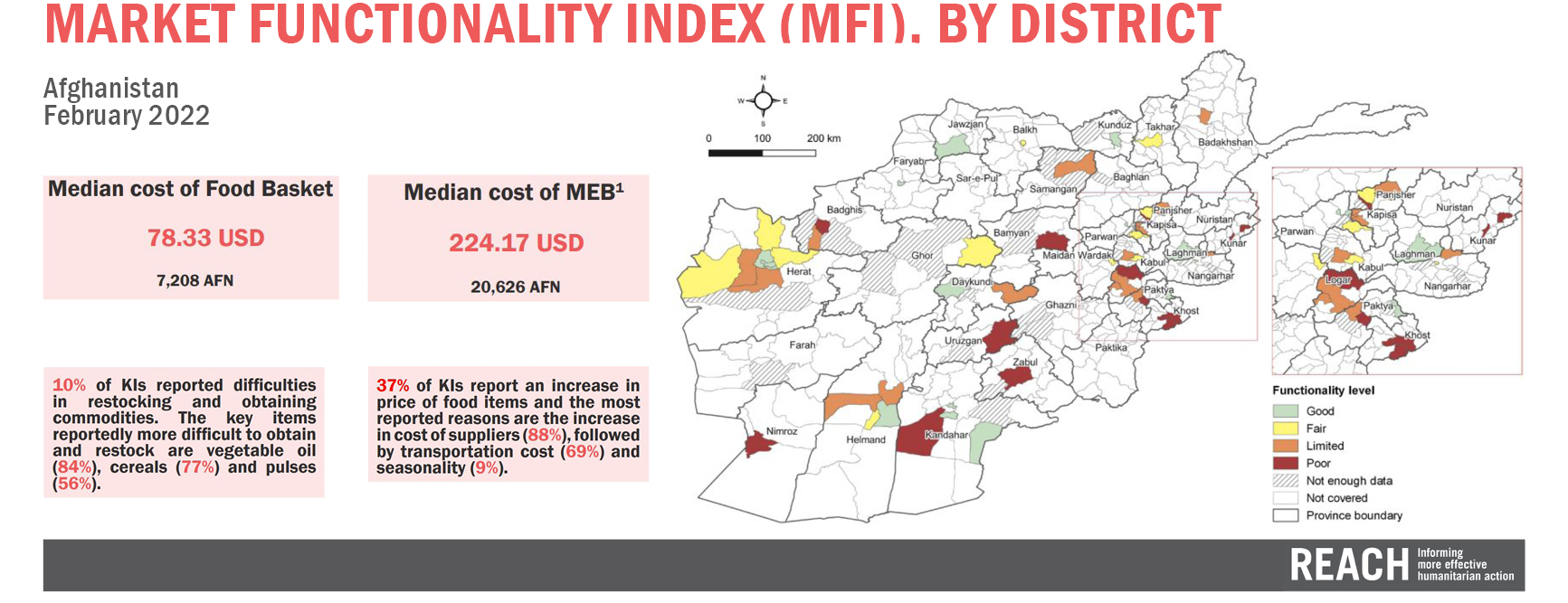

14/04/22 – AFGHANISTAN – Longitudinal market functionality trends in the context of the economic crisis

In the wake of the Taliban takeover of Afghanistan in August 2021, the country has been experiencing an economic collapse that, combined with the legacy of decades of conflict and two successive years of drought, has led to unprecedented levels of need across the country. In light of this ongoing crisis, REACH in Afghanistan has worked closely with the Cash and Voucher Working Group and its implementing partners to continue monitoring the impact on market functionality and the prices of key items, to inform the humanitarian response. In March, REACH presented a market trends analysis (presentation can be found here) based on the findings of the Joint Market Monitoring Initiative (JMMI). In summary:

- Following the spike in food prices observed between July and December 2021 (+37% in the cost of the food basket), the first quarter of 2022 has shown an inversion of the trend, with prices gradually decreasing, although remaining considerably higher than pre-August levels. One of the main contributing factors for the price oscillations is the volatility of the Afghani (that lost ca. 40% against the US Dollar between July and December and then appreciated by 22% during the first quarter of 2022). Such depreciation is to be linked to liquidity issues and limited foreign reserves (US dollars) the country experienced since the change in the de-facto authorities, suggesting that (further) cash injection in the economy is likely to support currency, hence, price stabilization. A second likely factor behind the rise in food prices is the soaring energy costs (+21% in the cost of petrol between September 21 and March 22), in line with the overall country inflation as well as global trends.

- Although items are overall more expensive, both food and non-food items are generally available on the market and the majority of retailers report being confident in their ability to resupply their stocks. Provincial differences are constantly observed for the different items across different months (i.e. limited availability of local wheat was reported in the eastern provinces of the country in March 22) and close monitoring of unavailability can support early identification of supply chain disruptions.

- Following the market disruptions observed in August 2021, traders are progressively reporting fewer difficulties in meeting the demand (10% of KIs in March 22). However, there has been an observed shift in challenges to procuring supply: decrease in transportation issues is paralleled by an increase in financial constraints affecting the ability of traders to purchase goods. Along the same lines, reported barriers faced by consumers to access markets have changed. As conflict has decreased throughout the country and movements are generally safer, reports of insecurity preventing access to markets have plummeted (from 41% in July 21 to 1% in March 22). Similarly, cultural barriers seem to be slightly declining, with nearly all traders reporting women being able to access markets (alone or accompanied). Conversely, financial barriers have been overall increasing as households’ ability to afford market products declines as their costs rise.

- Whilst markets appear overall functional and resilient, the soaring prices present the greatest challenge to traders and consumers. With the worsening of the economic conditions (decrease in income and livelihood opportunities coupled with an increase in food prices), households’ purchasing power is decreasing. This has the dual effect of both exacerbating household’s vulnerability levels, with an enhanced risk of further debt accrual and/or food insecurity, whilst also likely affecting retailers’ ability to purchase goods and trade.

- For the upcoming months, it will be important to monitor closely: 1. the impact international events such as the ongoing conflict in Ukraine may have on the supply chains in Afghanistan and commodity prices; 2. measures taken directly or indirectly to stabilise the Afghani, as this will have profound effects on the cost of living of the population; 3. Consumers and traders purchasing power: income, cost of labour and economic opportunities.

The JMMI will continue to be implemented on a monthly basis, with all data and publications available here.

06/12 – GLOBAL – The effects of the global COVID-19 pandemic on markets in humanitarian crises stemmed mostly from country-level restrictions on movement and trade, which in turn led to short-term price spikes and smaller long-term price increases in many contexts.

In its first two years, the COVID-19 pandemic exposed deep socioeconomic inequalities within and among nearly every country it touched, negatively affecting poorer populations’ access to everything from income-generating opportunities to medical facilities to basic protective supplies to vaccination against the disease. For crisis-affected populations, a potent economic challenge has been the unintended—or, in some cases, deliberate—side effects of ordinances imposed to protect public health. Restrictions on freedom of movement, mandatory closures of non-essential businesses, bans on the use of public transportation, limitations on daily labour, and constraints on the number of vendors and customers allowed to enter marketplaces have disproportionately affected the poorest members of society, in many cases cutting them off entirely from their livelihoods and their ability to afford basic goods to support their families.

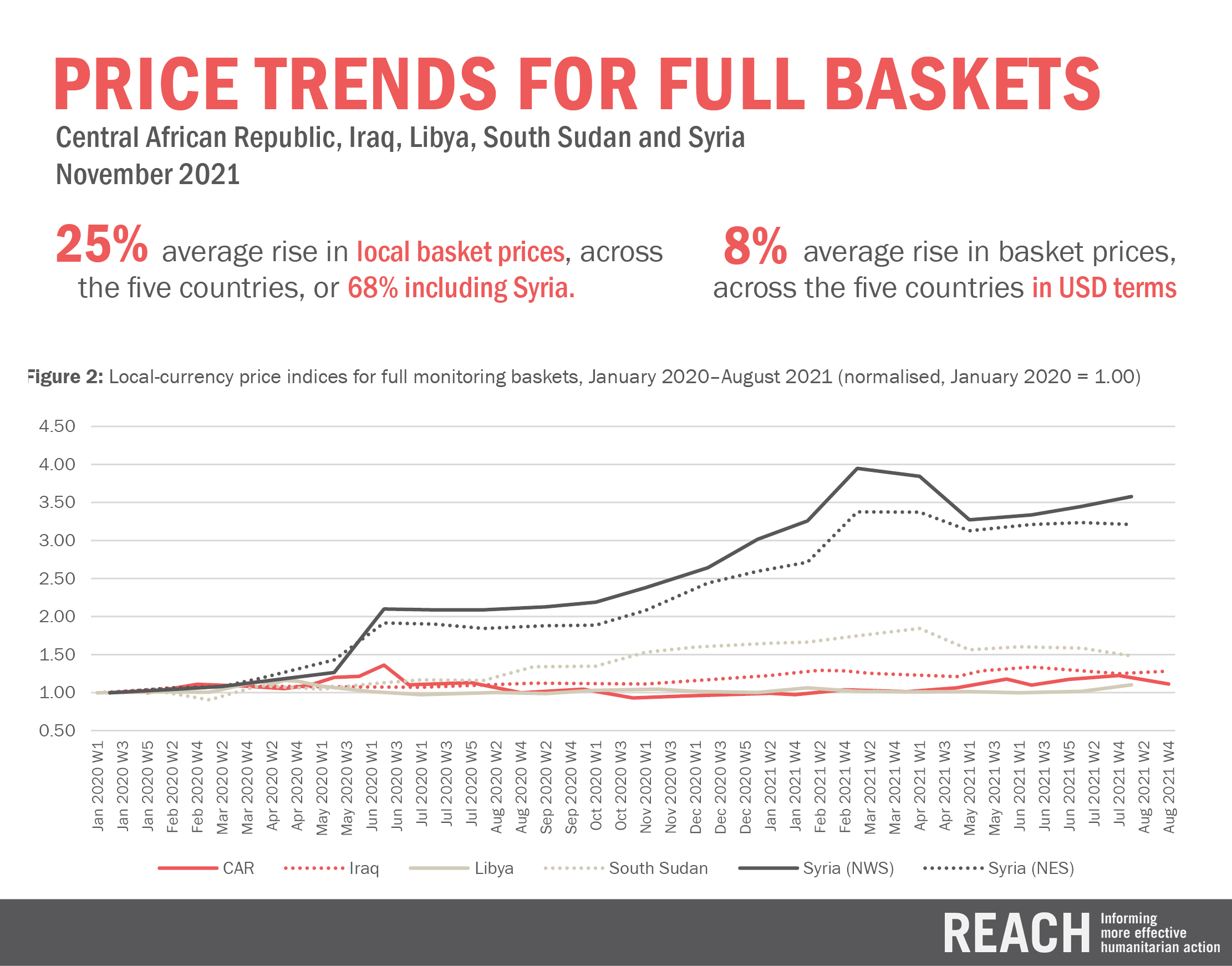

Throughout the COVID-19 pandemic, in conjunction with Cash Working Groups worldwide, REACH has been collecting market data through its Joint Market Monitoring Initiatives (JMMIs): response-level monitoring platforms that bring together many actors working in humanitarian cash and voucher assistance to jointly collect data on key commodities and marketplaces. Now, REACH has conducted its first cross-crisis analysis of JMMI data from eight countries—Afghanistan, the Central African Republic, Iraq, Libya, South Sudan, Syria, Uganda, and Yemen—to take stock of the pandemic’s effects on markets in humanitarian contexts between January 2020 and August 2021. The analysis revolves around cross-crisis comparisons of key indicators with the goal of discovering common trends, as well as developing initial, non-causational hypotheses around which of these trends may have been connected with the global COVID-19 pandemic and which were more likely to stem from local or national dynamics.

Across the eight countries treated in this analysis, increases were observed in the local-currency costs of most full monitoring baskets and sectoral components of those baskets, a development that eroded vulnerable households’ capacity to purchase basic food and non-food items at a moment when they could hardly afford further financial stress. In some countries, these increases were closely correlated with depreciation of the national currency, and in others may have been driven by highly local factors. In either case, though, the effects of the global COVID-19 pandemic on prices could be discerned mostly in the form of temporary, localised price changes in response to country-level restrictions on movement and trade.

Analysing indicators of market functionality over time, meanwhile, shows that certain aspects of functionality were closely correlated with lockdowns, restrictions on movement and importation of goods, and other aspects of country-level public health ordinances imposed to stall the spread of COVID-19. Other local factors, such as insecurity, seasonality, and pre-existing weather patterns, had strong effects on market functionality as well. Further research, in the form of both primary data collection and synthesis of existing country-level studies, will be needed to more fully understand the effects of COVID-19 on local markets by collecting local market actors’ perspectives on the differing dynamics that affected their businesses before, during, and after the pandemic.

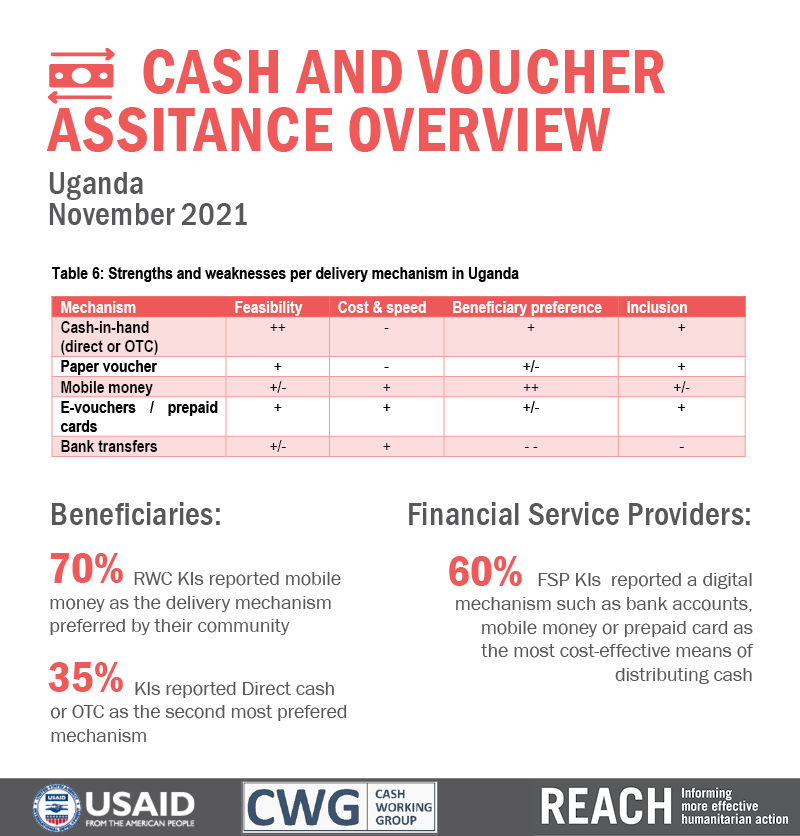

30/11 – UGANDA – “Financial service providers mapped to inform cash and voucher assistance

In Uganda, humanitarian organisations involved in the implementation of Cash and Voucher Assistance (CVA) have to navigate a complex landscape of available Financial Service Providers (FSPs) and delivery mechanisms in order to produce the most effective outcomes. In support of this, REACH conducted an assessment of FSPs and delivery mechanisms to identify opportunities and key challenges.

The report, commissioned by USAID’s Bureau for Humanitarian Assistance (BHA) and supported by the Cash Working Group (CWG) Uganda, draws on key informant interviews with FSPs, their agents, representatives of local communities and humanitarian organisations.

Key findings

- The operational presence of FSPs varies by location and type of FSP. In particular banks had a stronger presence in or nearby settlements in the South-West Region compared to the West Nile Region. Mobile Network Operators further reported to have larger agent networks inside refugee settlements compared to other types of FSPs such as banks and micro-finance institutions.

- The lack of operational presence or long distance to agents and branch locations was reported as the main barrier to accessing financial services and assistance.

- Mobile money was most frequently reported as a preference for receiving CVA, followed by cash-in-hand distribution.

- Low levels of literacy and digital literacy remain challenges associated with all digital delivery mechanisms such as mobile money, bank transfers and prepaid/smart cards.

- Great distances, the threat of COVID-19, and time consuming distributions were reported as the main challenges associated with cash-in-hand delivery.

As response actors in Uganda are increasing their coordination and collaboration, with the intention to harmonize their approach to CVA, this report aims to provide humanitarian organisations with the information they need to continue to navigate this process for the benefit of the communities they serve.

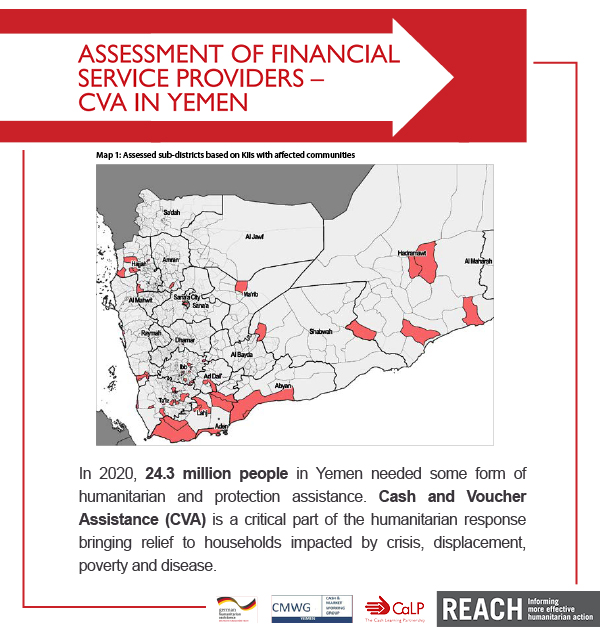

21/09 – YEMEN – Mapping Cash & Voucher Assistance landscape

Cash and Voucher Assistance (CVA) is a critical part of the humanitarian response in Yemen, but involved humanitarian organisations have to navigate through a complex and dynamic web of financial regulations, delivery mechanisms, Financial Service Providers (FSPs) and contextual challenges. As a response, REACH conducted an assessment to map Yemen’s CVA landscape and identify best practices and key challenges.

The report, commissioned by the Cash and Learning Partnership (CaLP) and supported by the Cash and Markets Working Group (CMWG) Yemen, draws on key informant interviews with members of local communities, humanitarian organisations and FSPs.

It was found that community members most commonly reported using informal money transfer mechanisms, such as local exchange offices (71%) and hawala’s (64%). This preference and familiarity with agents can be leveraged for a range of delivery mechanisms, but humanitarian organisations also reported challenges with these agents related to corruption and incompliance with humanitarian standards.

A main obstacle for vulnerable groups to collect assistance was the distance from FSPs, and this was also the main reason for all assessed communities to dislike any delivery mechanism.

75% of urban communities reportedly have an ATM in their community, and 49% can reach a bank branch within 15 minutes, indicating the presence of infrastructure for digital CVA modalities.

Mobile money as delivery mechanism can be provided by at least four FSPs and is piloted on small scale by one interviewed humanitarian organisation.

Tokens are identified as a best practice. It helped humanitarian organisations to achieve the monitoring of payments and faster reconciliation in a low-tech manner: without requiring internet and applicable for the widely used cash-in-hand delivery.

Learn more: https://bit.ly/2Z1vfD6

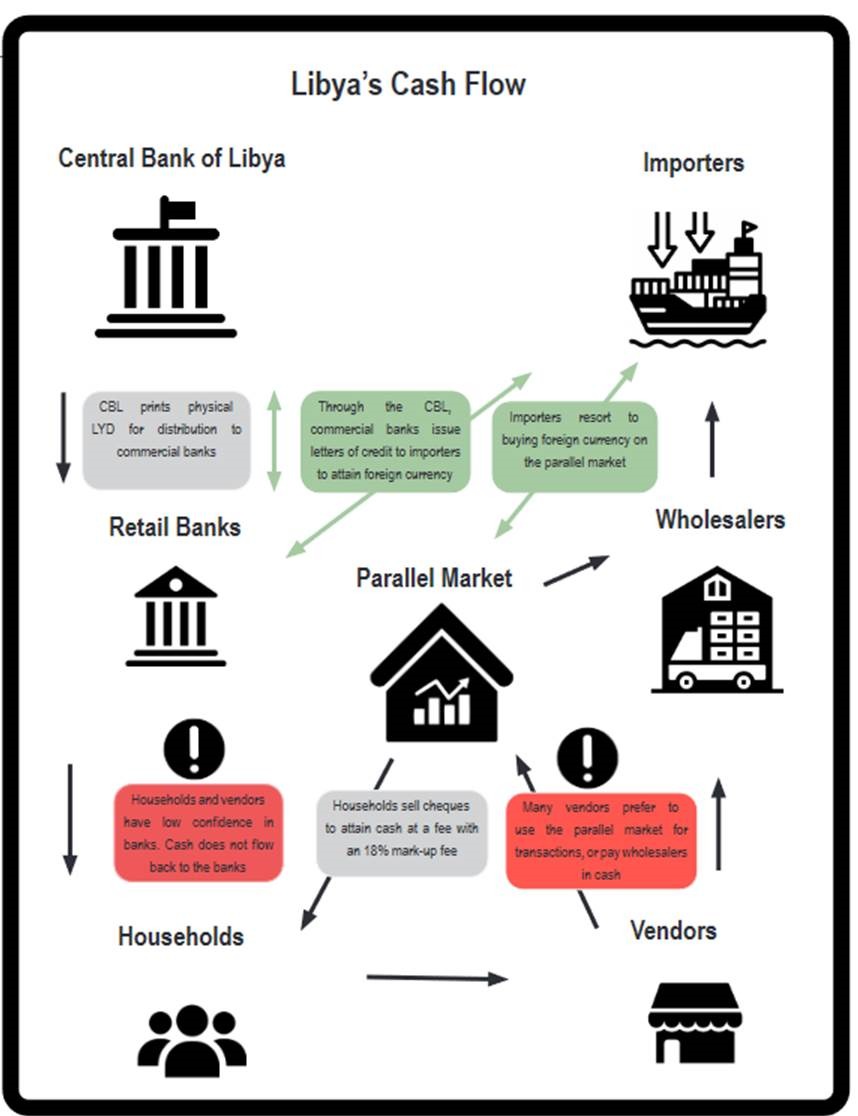

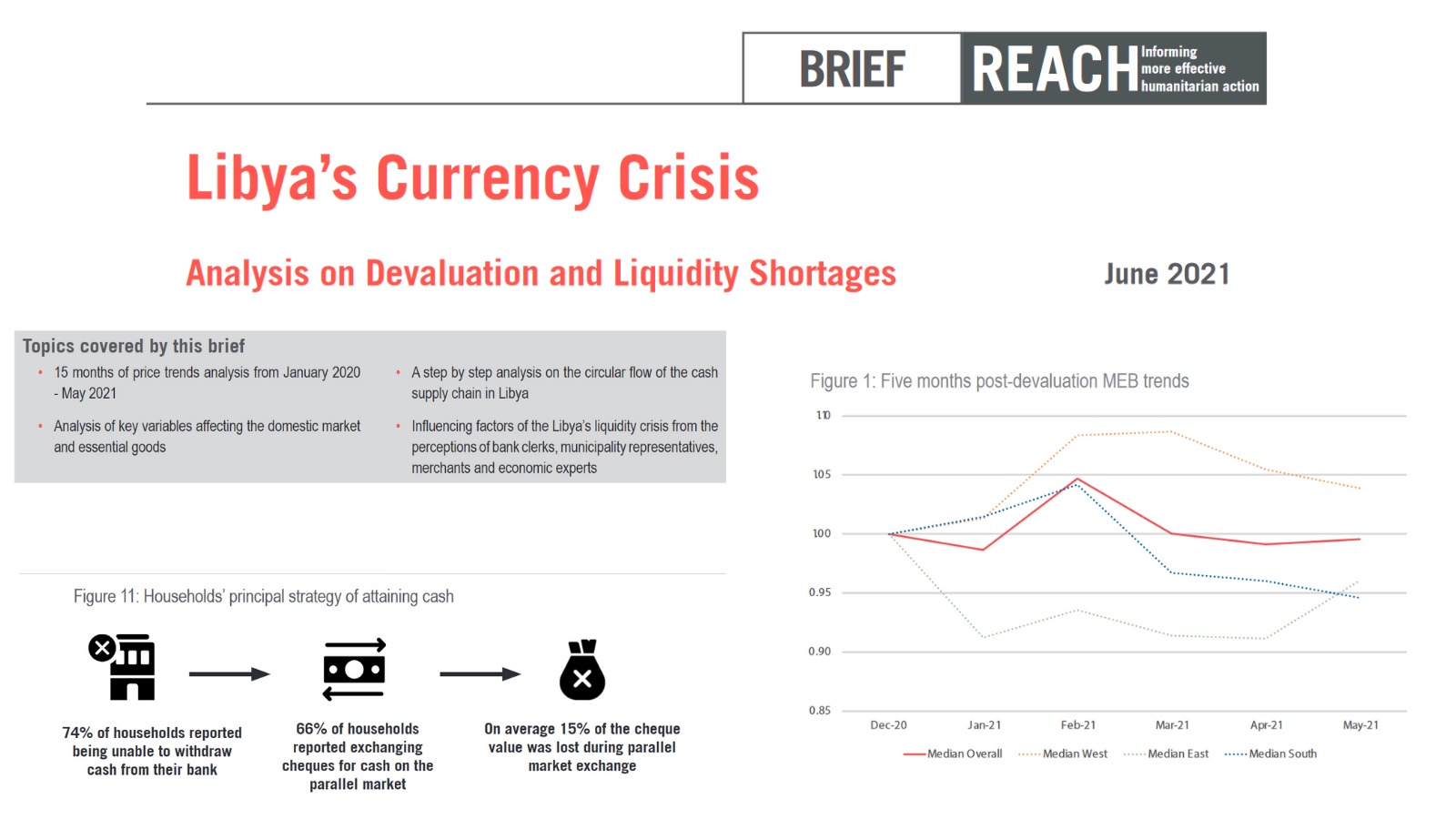

23/07 – Libya’s liquidity crisis – exchange rates, letters of credit (LCs), international prices, conflict, and oil production are impacting the cost of essential commodities

The 2020 Libya Multi-Sectoral Needs Assessment found that cash and markets related needs were the most prevalent needs amongst assessed households, which also most commonly overlapped with needs in other sectors. Therefore, REACH teams conducted an additional assessment aimed to support a more detailed understanding of the drivers of the ongoing liquidity crisis in Libya, and the impact thereof on the Libyan population. The methodology consisted of a mix of longitudinal Joint Market Monitoring (JMMI) price data analysis, as well as structured and semi-structured interviews with bank clerks, municipality representatives, parallel market/hawala actors, merchants, and Libyan households.

Topics covered by this brief

- 15 months of price trends analysis from January 2020 – May 2021

- Analysis of key variables affecting the domestic market and essential goods. A step by step analysis on the circular flow of the cash

supply chain in Libya - Influencing factors of the Libya’s liquidity crisis from the perceptions of bank clerks, municipality representatives, merchants, and parallel market/hawala actors

The final brief contains, among others, an interesting summary infographic that, through mapping the flow of cash through the closed circuit supply within Libya, visualizes the main bottlenecks and factors in cash circulation driving the crisis, such as low confidence in banks among merchants and households, and a resulting preference for parallel market financial exchanges.

Learn more by reading the Libya Devaluation and Currency Crisis Brief

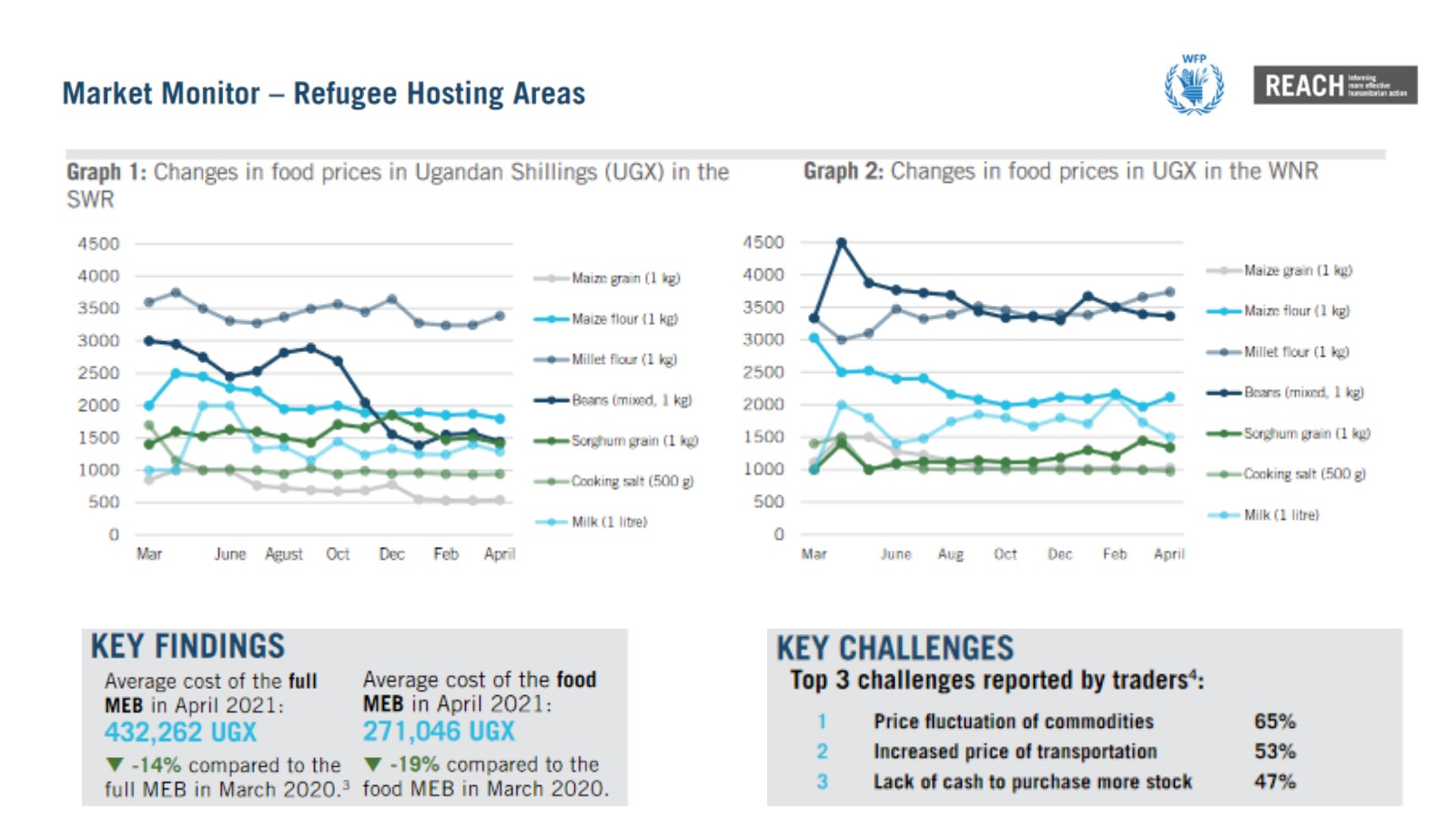

22/06 – Uganda – Monitoring the markets in refugee hosting areas is key as Uganda is hard hit by COVID

As Uganda is among some African countries seeing a dramatic rise in the number of infections (a total of 68,779 confirmed infections, including 584 deaths) amid a vaccine shortage, it will be crucial to assess the impact of the tightened lockdown measures on markets and purchase power – in particular for refugees. Indeed, Uganda is one of the top refugee-hosting countries in the world, with a protracted refugee situation and ongoing influxes of refugees from neighboring countries. The country hosts 1,494,505¹ refugees as of 1 June 2021, with nearly 95% of refugees living in settlements primarily in the West Nile and Southwest regions of Uganda.

In view of this situation, the World Food Programme (WFP) has established a regular market price monitoring system across refugee settlements to inform cash-based response approaches. These monitoring efforts predate the COVID-19 crisis. However, due to the changing situation since the Ugandan government introduced COVID-19 containment measures in mid-March 2020, there is a risk that markets could be significantly affected and beneficiaries receiving cash assistance may not be able to access critical goods. In response, with the technical support of the Market Analysis Task Force and REACH in particular, this market price monitoring system has been expanded to capture crucial information to understand the impact of COVID-19 on commodity prices and functionality of markets in refugee communities across Uganda since March 2020.

Main findings from the latest round (April 2021):

- Across regions, prices for key food items in the Minimum Expenditure Basket (MEB) have mostly remained stable. Since January, the price of millet in West Nile Region (WNR) has increased by 12% from 3400 to 3800 UGX. In Southwest Region (SWR) there has been a slighter increase. The price of maize flour increased by 16% from 1900 to 2200 UGX per KG in April.

- Nationally, 15% of the interviewed vendors reported difficulties in meeting demand and 13% of the interviewed vendors reported concerns about their stocks running out. However, these challenges are more frequently reported by vendors in WNR (24%) compared to those in the SWR (3%)

- The WFP cash transfer value could cover only 35% of the food MEB (41% in South West and 32% in West Nile).

- The market price of the WFP GFA food basket registered a marginal month-to-month increase of 2% from February to April 2021.

The Market Analysis Task Force will continue to monitor market prices and functionality over the coming months, with a particular focus on understanding the effects of the recently announced lockdown on price levels in refugee settlements.

For more information on the Market Monitoring in Uganda: https://www.reachresourcecentre.info/country/uganda/theme/cash/

Stay tuned to get the info on the most recent Market monitoring rounds by subscribing to our Resource center alerts: https://www.reachresourcecentre.info/subscribe/

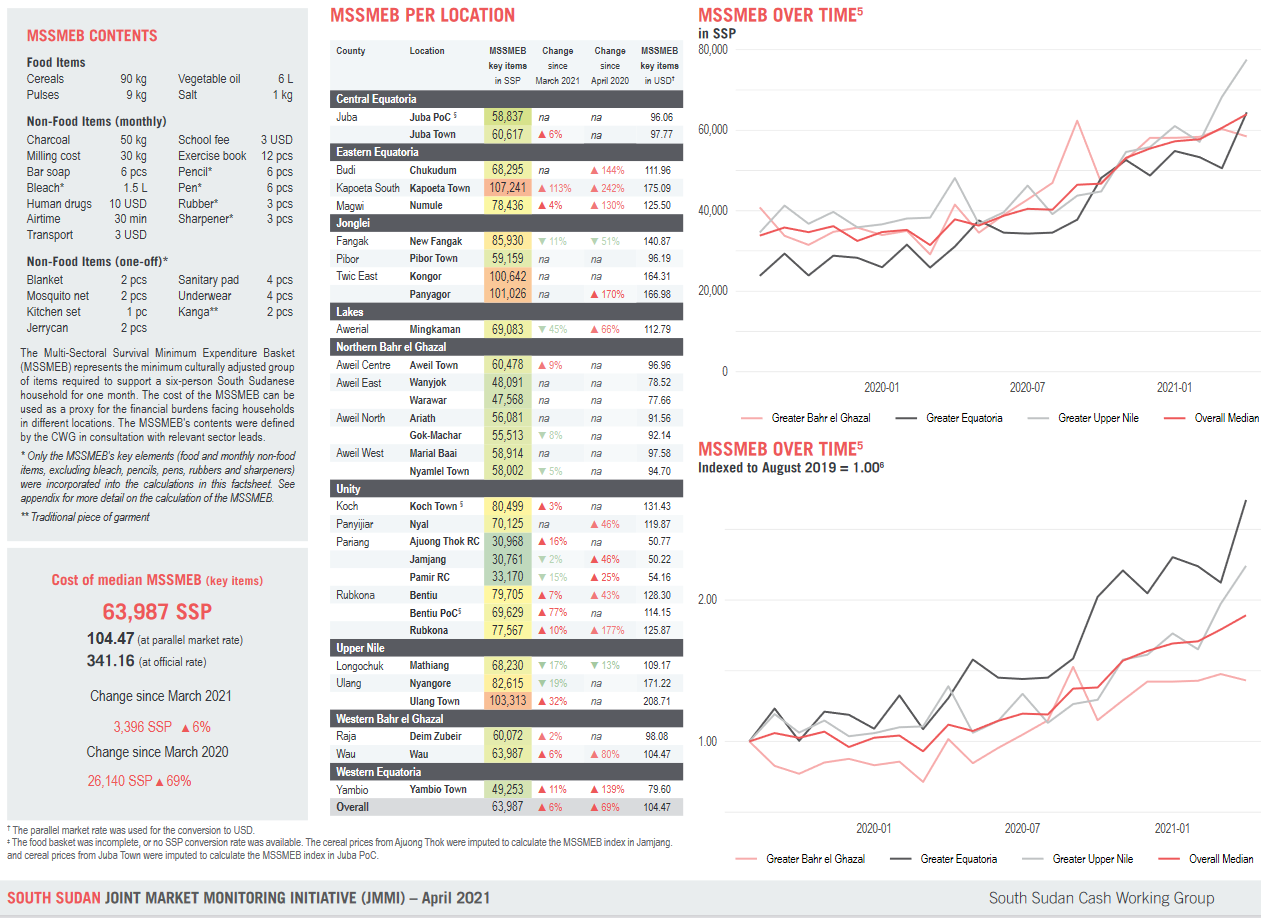

31/05 – South Sudan – Significant increase in the price of crucial goods in Eastern & Western Equatoria represents a threat for affected communities

To support the effective utilization of cash and vouchers as a modality of humanitarian assistance – destined to strengthen three of the nice Grand Bargain work streams – the Joint Market Monitoring Initiative (JMMI) was created by the South Sudan Cash Working Group (CWG) in 2019. This initiative benefits from the technical support of REACH, funded by the World Food Programme. Marketplaces across South Sudan are assessed on a monthly basis. The goal? To keep a close eye on the cost of the Multi-Sector Survival Minimum Expenditure Basket (MSSMEB) in the country.

Down to its core, the Multi-Sectoral Survival Minimum Expenditure Basket (MSSMEB) represents the minimum culturally adjusted group of items required to support a six-person South Sudanese household for one month. The cost of the MSSMEB can be used as a proxy for the financial burdens facing households in different locations. The MSSMEB’s contents were defined by the CWG in consultation with relevant sector leads.

To ensure that calculations are provided accurately for the entire country, the JMMI in South Sudan benefits from the participation of 20 aid agencies. Data collection takes place across over 30 locations spread out across the country, and closely monitors the fluctuation in price of 20 key commodities.

The latest output of the JMMI in South Sudan from data collected in early April revealed some concerning trends regarding the increase in price of the MSSMEB, particularly in the Eastern Equatora region:

- In the first week of April 2021, the highest Multi-Sectoral Survival Minimum Expenditure Basket (MSSMEB) prices were recorded in Kapoeta Town (Kapoeta South), Kongor, Panyagor (Twic East) and Ulang Town (Ulang). The high MSSMEB prices in these locations were driven by high reported cereal prices of 700 SSP, 718 SSP and 683 SSP per kilogram respectively.

- The highest Multi-Sectoral Survival Minimum Expenditure Basket (MSSMEB) was recorded in Kapoeta Town (Kapoeta South) an increase of 113% since March, 2021.

- In just a year, the price of the MSSMEB has increased enormously in three counties in Eastern Equatoria: 144% in Budi, 242% in Kapoeta South, and 130% in Magwi.

- In Kapoeta town, this trend is particularly concerning given the fact that the price of the MSSMEB increased by over 110% since last month!

- A similar increase is witnessed in Yambio town, where the MSSMEB increased by 139% in comparison to last year.

For more information on the JMMI in South Sudan or to view previous rounds of data collection, please feel free to explore its dedicated section on the REACH Resource Centre: https://www.reachresourcecentre.info/country/south-sudan/cycle/723/#cycle-723

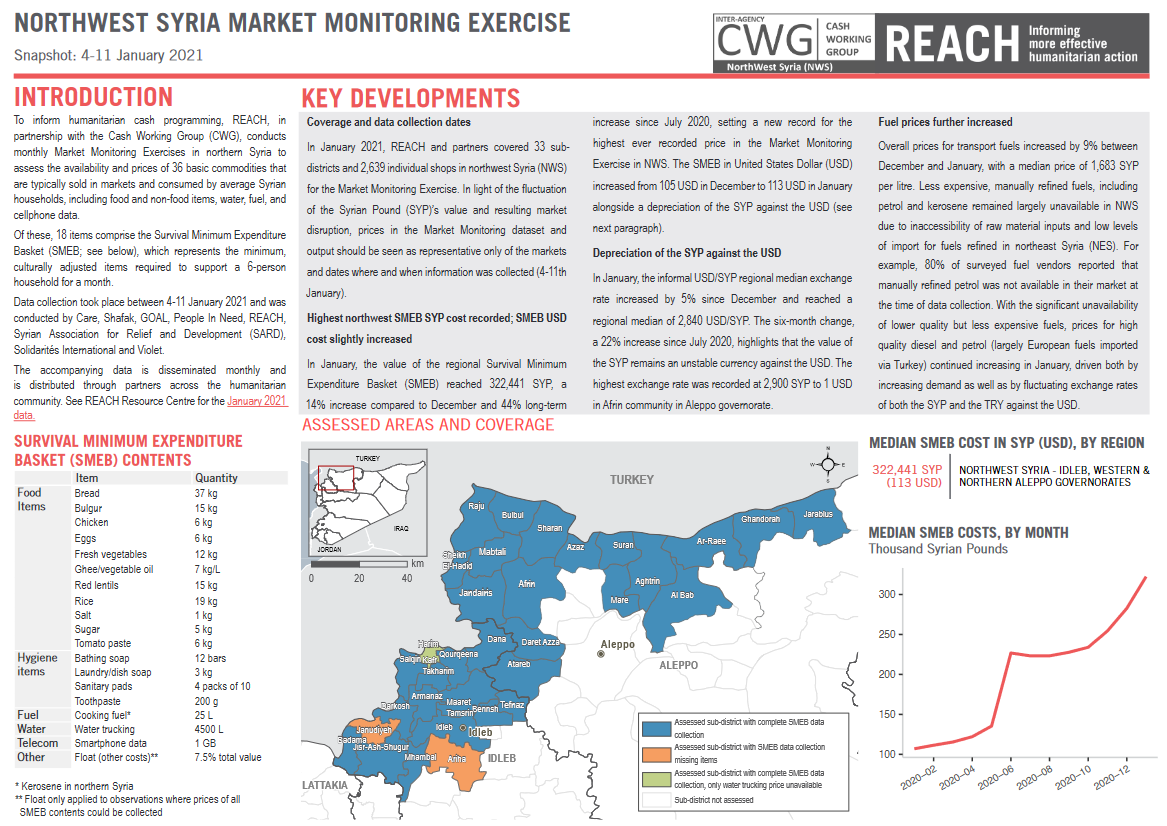

09/04 – Syria – Highest Survival Minimum Expenditure Basket value ever recorded in Northeast & Northwest regions

Syria’s Survival Minimum Expenditure Basket (SMEB) represents the minimum culturally adjusted set of food and non-food items required to support a 6-person household for a month. To ensure these items remain available and accessible for populations in need, and to monitor fluctuations in prices which can have a negative impact, REACH and its partners collect monthly information on the prices and availability of 36 basic commodities across Northern Syria, among which 18 are in the SMEB.

In January 2021, REACH and market monitoring partners such as CARE, GOAL, People in Need, and the Syrian Association for Relief and Development (SARD) collected data from 33 sub-districts in the northwest part of the country and 26 others in the northeast. In total, over 4,000 individual shops were assessed in the process.

Results from the situation overviews published in the northeast and in the northwest showed that the value of the regional SMEB was the highest ever recorded. The value of the SMEB increased respectively by 44% and 38% in the Northwest and Northeast regions of Syria.

Having a SMEB value so high is concerning. The SMEB represents a household’s core, non-negotiable expenses, and such high figures suggest that these households are finding it hard than ever before to make ends meet.

Data collected throughout these regions highlighted the extent to which the depreciation of the Syrian Pound (SYP) has had a severe effect on households’ ability to afford basic food items, such as meat and vegetables.

Since July 2020 the SYP depreciated by 22% against the US Dollar (USD) in the Northwest, where the highest exchange rate was recorded in the Afrin community in Aleppo governorate. In the northeastern part of the country, the areas most affected by the depreciation of the SYP are mostly located in the Ar-Raqqa governorate.

Of notable concern, 80% of the total vendors surveyed in Northeast Syria and 78% in Northwest Syria reported that price inflation remained their primary challenge for supplying their stores. Price inflation is particularly prevalent in Idleb.

For more information on the situation of markets across Northern Syria, please feel free to download the January 2021 situation overviews from the Northwest and the Northeast.

Further datasets, reports, and fact sheets from the market monitoring exercises conducted in Syria can be accessed on the REACH Resource Centre.

09/04 – South Sudan – 21 humanitarian partners involved in the Joint Market Monitoring Initiative

In South Sudan, a continued and protracted macro-economic crisis, accompanied by currency depreciation, has resulted in high food prices, eroded household purchasing power, and made food unaffordable for a significant proportion of the population. Disruptions caused by COVID-19 to the supply chains of both commercial and humanitarian actors worsened the severity of food insecurity.

The latest Joint Market Monitoring (JMMI) fact sheet published in March is based on data collected on 21 basic commodities drawn from the Multi-Sector Survival Minimum Expenditure Basket (MSSMEB) across 52 marketplaces.

The key findings reveal that the cost of the food basket has increased by 9% nationally in the span of a single month, with certain areas witnessing even more severe increases across just two weeks, such as Juba town (60%), Akobo (75%), and Kapoeta (79%).

The full MSSMEB has increased by over 90% between March 2020 and March 2021.

The prices of certain items have severely increased in just over a week, as reported by the JMMI factsheet, such as rice (+120%), sorghum grain (+102%), maize grain (+62%), and flour (+61%).

The full catalogue of cash and markets assessments conducted in South Sudan are also accessible on the REACH Resource Centre.

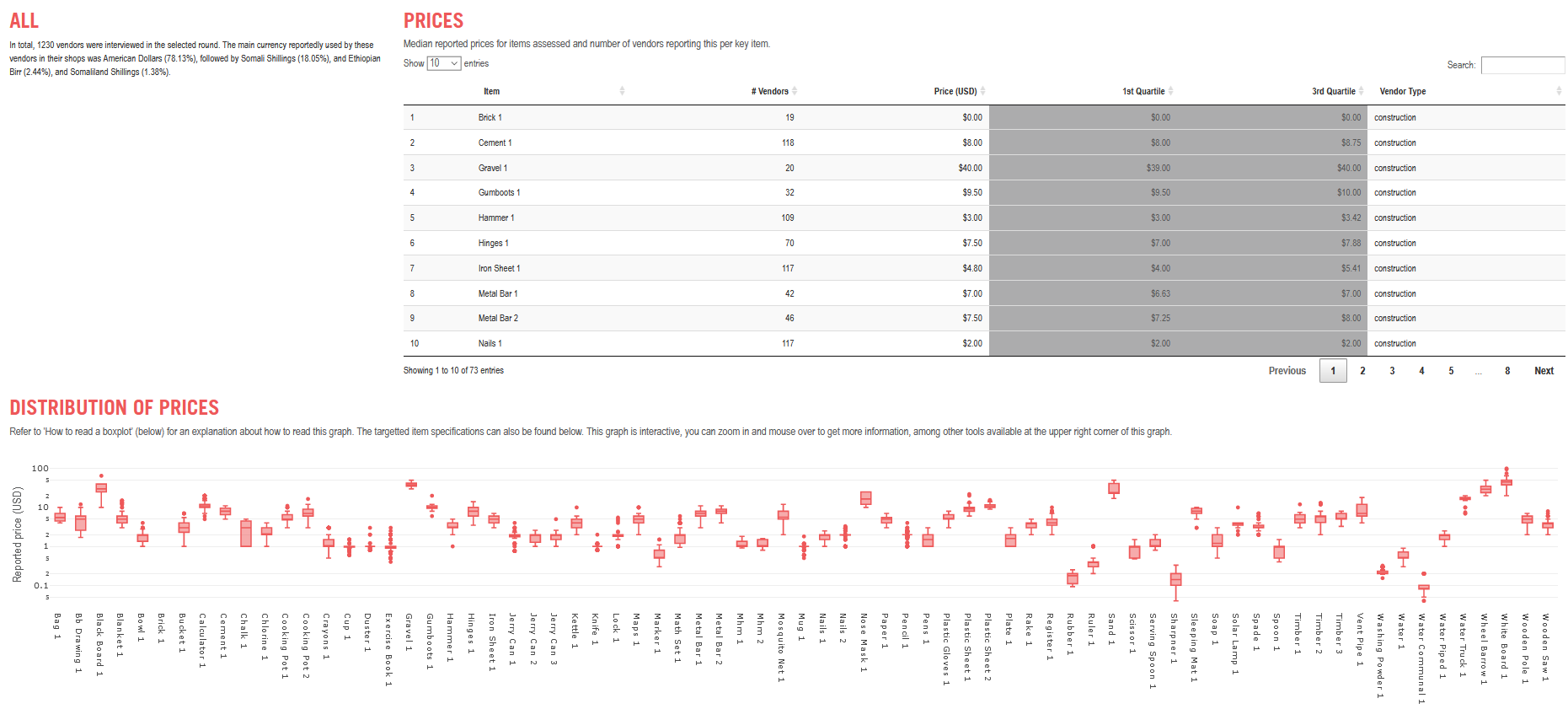

09/04 – Global – Regularly updated Market Monitoring dashboards in Syria, South Sudan, Somalia, Yemen, Libya, and Iraq

To keep aid actors informed on a regular basis and provide the humanitarian community with up-to-date data from its Joint Market Monitoring Initiatives, REACH has launched interactive dashboards in . Through these dashboards, humanitarian partners can consult all of the information collected, tailoring their searches to retrieve the key information they are looking for within a precise time-range, for certain specific commodities, or within a precise geographical area.

Screenshot of a section of the Joint Market Monitoring Initiative dashboard in Somalia. Click here to access where the dashboards are hosted.

For more information

All of REACH’s cash and markets assessments conducted around the world can be accessed on the REACH Resource Centre through the dedicated Cash section. Users can freely explore the anonymised datasets as well as downloading final published outputs.

The examples provided above represent only a snippet of market monitoring activities that REACH is leading across the world. Aside from the countries highlighted above, REACH is also involved in market monitoring data collection in